VESSEL delays ate up about one quarter of container-shipping capacity deployed on the trans-Pacific routes in January-April 2021, according to research and advisory company Sea-Intelligence.

In a recent report, Alan Murphy, CEO, Sea-Intelligence said the current shortage of vessel capacity and of empty containers is primarily driven by supply-side effects.

“As more capacity is currently deployed than ever before, the shortage must in turn be caused by poor utilisation of the deployed assets, specifically due to the unprecedented levels of congestion and the resulting vessel delays,” he said.

To investigate how much capacity the vessel delays effectively are removing from the container-shipping market, Sea-Intelligence followed what it said is a simple approach.

“As an example, a carrier offers a six-week roundtrip service with six 10,000-TEU vessels. If vessels are then five days late on the head-haul and two days on the back-haul, it increases the round-trip to seven weeks, requiring one additional 10,000-TEU vessel to compensate for the delay-induced loss of capacity,” Mr Murphy said.

“So to maintain the same weekly capacity, the carrier de-facto needs to increase nominal capacity by 16.7%. The effect of this is exactly the same, as if market demand had increased by 16.7%, as that would have required the same injection of net capacity in the market.”

Using data from Sea-Intelligence’s industry-leading Global Liner Performance (GLP) and Trade Capacity Outlook databases, the researchers found that while 2-4% of capacity is usually lost to vessels delays, approximately 25% of the capacity deployed on Transpacific in January-April 2021 has been soaked up by vessel delays, far outpacing the 17% soaked up by the 2015 US West Coast labour dispute.

While Asia-Europe has seen less dramatic congestion and delays, 11% of the capacity deployed in the first four months of 2021 was soaked by vessel delays.

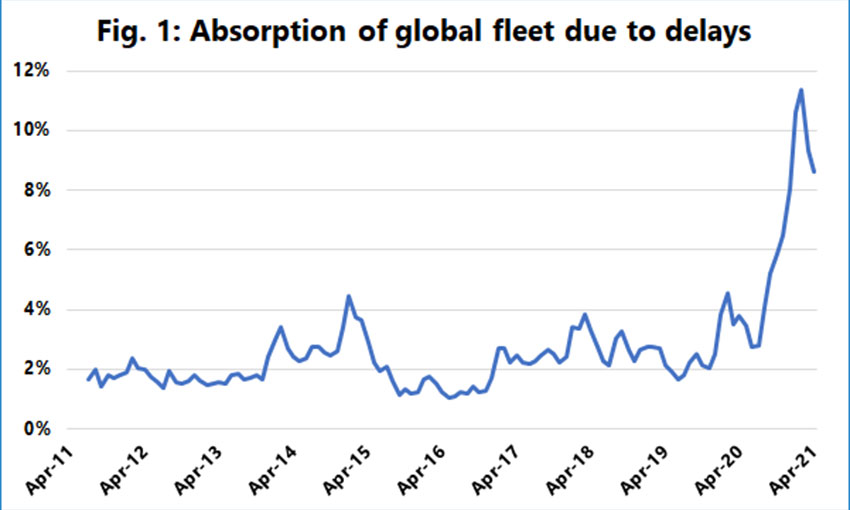

Mr Murphy said from a global perspective, at the height of the congestion in February 2021, almost 12% of global container capacity was absorbed by vessel delays and in April this was still at 8.6%.

“In nominal terms, this means that in February 2021, 2.8 million TEU of nominal vessel capacity was absorbed due to vessel delays, and in April 2021 this has only abated slightly to 2.1 million TEU,” he said.

“For comparison, the entire global fleet of ultra-large container vessels of 18,000 TEU and above, has a combined capacity of some 2.7 million TEU. Hence, in very real terms, the congestion problems in 2021 is of such a magnitude, that the effect is the same as if the entire industry had decided to remove all ultra-large container vessels from the fleet without adding any new vessels.”