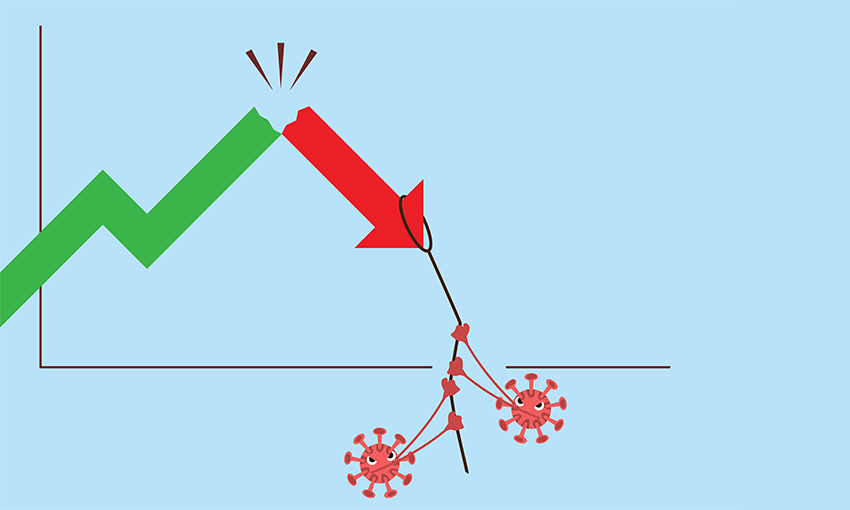

CORONAVIRUS has quickly spread across the globe, infecting and killing people around the world. The virus has also infected markets, which have been hit with extreme volatility and seen the crash of global equities. US Equity markets had reached all-time record highs prior to the outbreak, but have since been hit hard, although the last week has seen a rebound.

Bear markets

Global equities crashed into ‘bear market’ territory and have likely thrown the global economy into a sharp recession. Governments and central banks have reacted quickly and with actions never seen before. Global governments have passed massive fiscal stimulus packages in an effort to stabilise markets and cushion the effects of a global shutdown. The first problem is to arrest the virus and contain the spread. This is being done by different levels of social confinement and ‘social distancing’.

Containing the spread

Countries around the world have acted to confine the populations at home except for emergency services. This is containing the spread while authorities build resources in an effort to combat the spread of the virus and protect the vulnerable in society. The ‘shutdown has had a devastating impact on business and workers. Governments have launched unprecedented and massive support packages for business and workers. The fiscal stimulus is an effort to keep economies on life support from a government-induced coma.

Central Bank actions

Central banks, led by the Federal Reserve, have acted to provide monetary assistance through massive injections of liquidity. The RBA, RBNZ, Bank of England, ECB and Bank of Japan have all acted to flood markets with liquidity. They have launched unprecedented ‘QE’ programs and additional, never seen before actions. Central Banks have acted quickly to fund banks and business through the existing banking system, buying both private and public debt. Debt ‘monetisation’ is now an instrument employed by these central banks. That is, central banks buy up the government debt (issued through fiscal support packages), from their respective treasuries.

Currencies affected

The impact on currencies has been dramatic. The devastating effect on the markets has seen a sharp flight to the safe haven of the US dollar, which had forced the AUD below 0.5600, at the nadir of the market collapse. The strong rebound in the last week, after fiscal and monetary emergency action, has seen the AUD recover to trade above 0.61. Pricing is wider than normal and risk management is key to business management. The AUD cross rates have been far less volatile, so it is US Dollar exposure that must be managed.

Conclusions

These social, fiscal and monetary emergency actions are designed to carry the economy, business and people through this crises. The real question is, how long can and will, this continue? Governments must ‘contain and control’ infection rates, flatten the infection curve, treat and isolate. This will determine how long this crises continues. This is a sharp shock to the economy and as long as authorities can gain control of the virus in weeks (rather than months) the economy will rebound very quickly. The damage will take time to repair (especially to national balance sheets). The balance will be between the damage the antidote does to the economy, before the cure is found.