SHIPPING data analyst Sea-Intelligence has forecast continued trans-Pacific vessel pressure coinciding with the rising number of deployed vessels.

In a recent report, Sea-Intelligence CEO Alan Murphy said an increase in the number of vessels deployed each week will continue to contribute to port congestion.

“In very simplified terms, it is less efficient to handle two 5000 TEU vessels than it is to handle one 10,000 TEU vessel, once the time to get to and from berth is factored in,” Mr Murphy said.

“A change in the number of vessels will therefore be an element feeding into the congestion issues.”

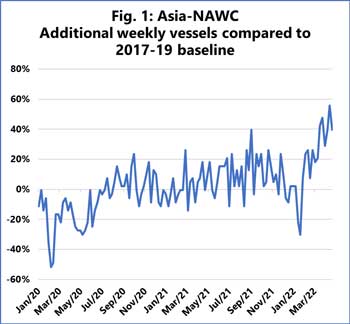

The report suggested there was an unusually large decline in the number of deployed vessels during the early pandemic period, with the number of blank sailings rising rapidly.

Following the low numbers of ships deployed during the early months of 2020, figures reportedly returned to normal, reaching a high point toward the end of the 2021 peak season.

The trend dropped again briefly during the Chinese New Year period but was followed by a sharp upward correction leading into the outlook for the coming months.

“With the recent data, we can see a seasonal dip due to Chinese New Year 2022, but it is the increase in March/April 2022 which should be particularly noticed,” Mr Murphy said.

“The number of vessels scheduled to depart Asia – and subsequently arrive on the North American West Coast – will increase sharply and surpass a 40% increase compared to the pre-pandemic normality.

“This in itself will add further pressure on the port infrastructure.”

The data indicates there will be a 60% increase in the number of vessels on the Asia-North America East Coast trade lane in the coming months.

According to Mr Murphy, the “alarming” forecast increase will be attributed to carriers attempting to circumnavigate port congestion on the North American West Coast.

“This will severely increase pressure on the port infrastructure on the East Coast,” he said.