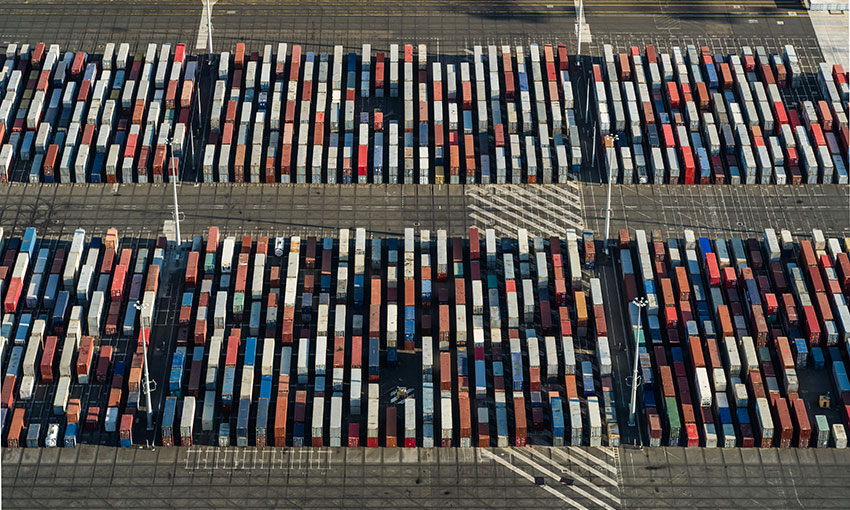

THERE is no doubt that the international container shipping market is a mess.

It is axiomatic that the ships are at capacity, there aren’t enough containers in the right places and demand went through the roof last year and is nearing the Moon now.

But this is where consensus among the various elements of the container supply chain breaks down.

Global Shippers Forum, an international advocate for shippers and cargo owners, has partnered with independent consultancy MDS Transmodal to analyse the state of the market over the second quarter of this year.

The report they produced, the Container Shipping Market Review, shows what GSF said is a “rapidly disintegrating container shipping market,” as deployed capacity fails to keep pace with demand. The organisation said shipping rates are escalating beyond reach for many small and medium-sized businesses.

The report shows a slight increase in the numbers of ships deployed, which allowed higher numbers of containers to be moved in Q2 following a lull in the first quarter of 2021.

MDS Transmodal chairman Mike Garratt said global levels of container traffic grew in Q2 2021 to reach record levels but have still not recovered to the level that trends implied three years ago, when lines reduced their level of new buildings.

“Capacity shares based on vessel sharing agreements (or consortia) in some key markets now exceed 40%. This high level of consolidation has the benefit of enabling lines to adjust capacity allocation in line with changing demand but, combined with the resulting very high levels of utilisation, have allowed freight rates to remain at historically unprecedented levels and imply that some potential freight may be being suppressed,” he said.

“Performance indicators, including skipped ports, continue to compare poorly with pre-pandemic levels.”

James Hookham, Director of the Global Shippers Forum said importers and exporters are facing a meltdown of the container shipping market, with rates in the stratosphere, slots up for auction and service performance in the trash.

“The prospects for the coming peak season look grim,” he said.

“What none of the industry metrics show are the huge numbers of shipments that are not being moved – the boxes left on the quay, stacked in the terminal or stockpiled in export warehouses awaiting a slot. Getting these goods to market will be the difference between economic recovery and empty shelves and consumer price inflation.”

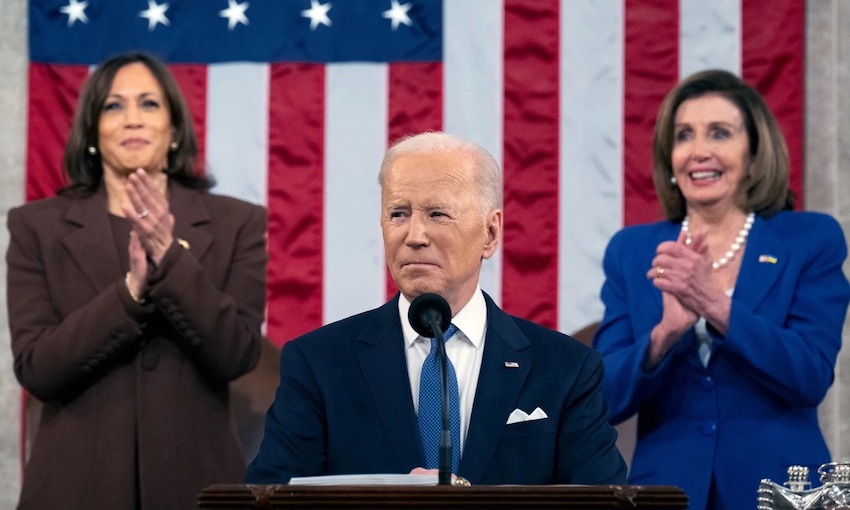

Mr Hookham called on governments to “look closer and harder at a shipping market that is out of control”.

The Container Shipping Market Review found that “unit operating costs for ships (US$/TEU) have barely moved over the past 18 months despite stronger charter rates and a recovered oil price. Earnings per container moved have doubled over the same period for no discernible increase in costs.”

The view from the ocean carriers

However, Shipping Australia said in a statement that shipping costs have “soared” since late May 2020.

The industry association representing Australia’s international ocean shipping industries said ship-chartering costs have increased by 773% since late May 2020 and marine fuel costs have near tripled from US$155.5 per tonne in April 2020 to US$435.5 per tonne now.

“The one-day cost of operating a 4250-box ship has blown out from about US$30,200 per day in mid-June 2020 to about US$151,400 a day now,” Shipping Australia said in a statement.

“A 10-day delay at an Australian port would therefore cost the shipping company up to about US$1.5 million for each delay for each ship. Do not be deceived by propaganda: the costs to operate a ship are high and they are increasing.”

Shipping Australia said the path out of the present container shipping crisis requires governments to buy and distribute vaccine supplies so lockdowns can be safely lifted

“All of these vaccine-related matters are outside of the influence of pretty much anyone in the shipper, shipping, or port and terminal operating communities,” Shipping Australia said.

“However, the big market-distorting maritime factor that can be, and needs to be, tackled on an Australian and global scale is port congestion and poor port performance. A supply equivalent to the global fleet of the world’s biggest ships is being effectively squandered by ships being forced to waste time in port congestion queues.

“Shipping Australia urges shippers to direct their lobbying efforts to where it is truly needed: at port congestion and poor port performance.”

Shipping Australia CEO Melwyn Noronha said, “misleading statements from certain elements in the shipper community are painting a false picture of the shipping industry, which has been highly resilient and has provided excellent value for money right throughout the pandemic, despite all the restrictions imposed by governments”.